We Purchase Producing Royalties, Overriding Royalties, and Some Working Interests. We Offer a Simple Process To Sell Your Royalty Interest, While Getting You Exceptional Cash Value for Your Royalties...

CALL US TOLL FREE NOW AT 888-916-0220 OR COMPLETE THE ONLINE INFORMATION REQUEST TO RECEIVE YOUR FREE CONSULTATION and QUOTE TO SELL YOUR MINERAL RIGHTS!

We can advance up to 50% of the cash purchase price!

We can assist in providing information to enable you to make an informed decision if Selling is a good option for you! Read what other Customers have said about our Service.

Click here to Learn more

It is as Simple as 1-2-3 to Contact Us to Sell Your Oil & Gas Royalties:

Step 1

3 - Convenient Ways to Contact Us!

- Call 1-888-916-0220 (Toll Free) or 1-720-663-1187 (Local)

- Fill out our online form (right)

- Email us at sellroyalties[at]gmail.com or Fax your information to : 1-888-491-8525

Step 2

We'll send a FREE Quote in writing via Email or Fax within 24 Hours

Upon review and evaluating your property and information we will send you

an offer on your property within 24 hours.

Step 3

Whether you accept or not... There's NO Obligation!

If you accept the offer then we overnight all deed and all other pertinent

documents to you with return shipment at our expense. Once we receive the

executed transfer documents then we pay you... It's that Simple!

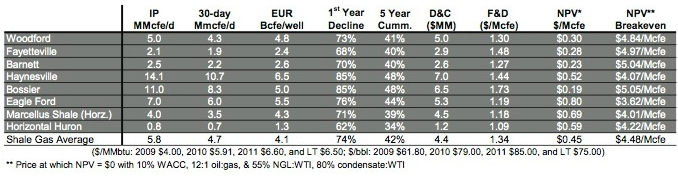

NOTE: We are particularly interested in acquiring all Oil & Gas Producing Royalties in the following Shale Formations: Marcellus Shale, Haynesville Shale, Fayetteville Shale, Barnett Shale, Granite Wash Play, Niobrara Shale, Eagleford Shale and Bakken Shale.

Once we have received submission of the necessary information to evaluate your Royalties and/or Mineral Interests, an Oil & Gas specialist will notify you within 24 Hrs. We are able to Purchase All or a Portion of Your Royalty Interest(s). If you are interested in selling Non-Producing Mineral Rights, please click here!

- We Offer Premium Dollar Payouts and Evaluations.

- We can Close as soon as 24 Hours upon acceptance and Cover all Cash Needs. (In qualified cases, we can advance as much as 50% of the Purchase Price).

- We Handle All Aspects of the Administration Process for Filing and Recording the Required Paperwork.

- No Concealed Fees or Charges, We Pay all Costs.

- No Delays in Getting Paid, Receive Your Funds At Once.

- No 30-60 Day Hold to Process Funding to receive Cash Payment.

Receive Instant Payment for Your Royalty Interest!

Please Provide the Following Information, as Applicable, for Our Review; either by Fax 720-746-2899 or Email to: sellroyalties@gmail[dot]com

- For Non-Producing Minerals: Oil & Gas Lease(s); please include statements or letters outlining payments of agreed upon signing bonus and terms of net acreage.

- For Royalties: Check Statements or ACH Statements for most recent 6 months of payments.

- For Working Interests: Check or Revenue Statements and Expense Statements for most recent 12 months, and Joint Operating Agreement if available.

- For All Interests: Any Conveyances, which can include any Mineral Deeds, Mineral Conveyances, Warranty Deeds, Recorded County Documents, Probated Wills and/or Assignments.